Autonomous trading infrastructure that works 24/7

TX Exchange Engine automates the most complex aspects of digital asset trading—liquidity provisioning, route optimization, and risk management—delivering superior execution with minimal intervention.

Intelligent Cross-Chain Routing

Our AI doesn't just find the best price—it finds the optimal path. The system dynamically evaluates 300+ blockchains and hundreds of liquidity sources, factoring in price impact, gas costs, settlement time, and network congestion to guarantee the most efficient execution for every swap.

Automated Market Making (AMM)

Deploy capital efficiently with our smart AMM infrastructure. Set custom concentration ranges, fee tiers, and rebalancing strategies. Our system automatically manages position health, mitigates impermanent loss, and compounds fees autonomously.

Dynamic Liquidity Optimization

Transform treasury assets into revenue-generating liquidity. The engine continuously analyzes yield opportunities across DEXs, bridges, and lending protocols, automatically allocating funds to the highest-performing strategies while maintaining required liquidity buffers.

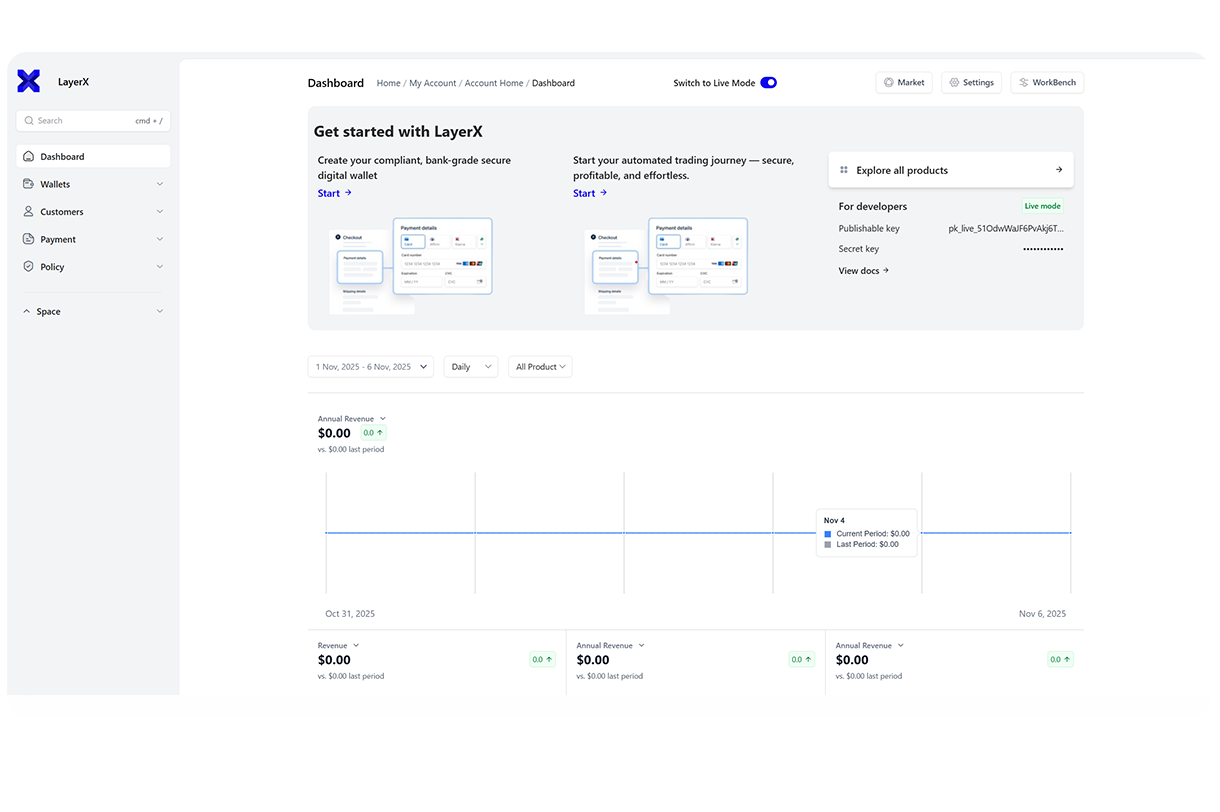

One API, infinite trading possibilities

From simple embedded swaps to sophisticated algorithmic strategies, our developer-first platform provides the tools and reliability needed to build competitive trading products at scale.

Unified Trading API

Access deep liquidity across centralized exchanges, DEXs, and private market makers through a single, standardized REST and WebSocket API. Eliminate the complexity of managing multiple integrations and liquidity sources.

Pre-Built Trading Modules

Accelerate development with our plug-and-play trading components.

- Embedded Swap Widget for frictionless user trading

- Liquidity Management Dashboard for real-time position monitoring

- Advanced Trading Interface with charting and order books

Cross-Chain Settlement Hub

Execute trades that originate on one chain and settle on another seamlessly. Our atomic swap technology and bridge aggregation ensure capital efficiency without manual intervention or wrapping assets.

- Real-time Price & Liquidity Feeds

- Webhook-based Trade Settlement Alerts

- Accounting & Reporting SDKs

- Compliance & Risk Monitoring Tools

Intelligence-driven trading execution

Move beyond basic price feeds. TX Exchange Engine delivers predictive analytics that transform liquidity management from a cost center into a strategic advantage.

360-Degree Liquidity Intelligence

Monitor your liquidity footprint across all integrated venues and chains. Track pool performance, fee generation, capital efficiency, and impermanent loss in real-time through unified dashboards.

Predictive Price Impact Modeling

Our AI engine forecasts how large orders will affect market prices across different venues and time horizons. Execute large trades with minimal slippage by splitting orders optimally across liquidity sources.

Real-Time Arbitrage & Opportunity Identification

Automatically detect mispricings, cross-chain arbitrage opportunities, and yield variance across integrated protocols. Turn market inefficiencies into profitable trading strategies.

Smart Risk Management & Monitoring

Set custom risk parameters for maximum drawdown, counterparty exposure, and volatility thresholds. Receive real-time alerts when market conditions approach your limits.

TX Exchange Engine delivers the infrastructure demanded by institutional traders.

- 300+integrated blockchains & layer 2s

- $10B+aggregated liquidity depth

- 99.99%platform uptime SLA

- <100saverage execution latency

Multi-Chain Wallet Infrastructure

Intelligent Order Routing

Cross-Chain Atomic Swaps

Custom AMM Deployment

Concentrated Liquidity Management

Smart Order Types

Liquidity Mining & Incentives

Real-Time Price Feeds

Advanced Charting & Analytics

Portfolio Rebalancing Automation

Yield Optimization Strategies

Institutional-Grade Security

Power your trading platform with institutional-grade liquidity.