Transform traditional banking with blockchain technology

01

Digital asset integration

Seamlessly incorporate cryptocurrencies, tokenized assets, and blockchain payments into existing banking services.

02

Regulatory compliance automation

Maintain full compliance across global jurisdictions with built-in KYC, AML, and financial reporting.

03

Next-generation settlement

Reduce settlement times from days to seconds while lowering operational costs by up to 70%.

Core Banking Solutions

Modernize traditional banking infrastructure

Digital asset custody

Institutional-grade custody with MPC technology, $500M insurance, and regulatory compliance.

Tokenized asset management

Issue, manage, and trade tokenized securities, commodities, and real-world assets on blockchain.

Cross-border payments

Process international transfers in minutes instead of days with 80% lower costs using blockchain rails.

Liquidity management

Optimize capital allocation across traditional and digital assets with AI-driven treasury management.

Commercial Banking

Corporate and business banking solutions

Corporate treasury services

Multi-currency accounts, automated cash management, and yield optimization for corporate funds.

Trade finance digitization

Blockchain-based letters of credit, trade documentation, and supply chain financing.

Commercial lending

Tokenized loan origination, syndicated lending platforms, and automated credit assessment.

Merchant services

Crypto payment acceptance, instant settlement, and fiat conversion for business clients.

Investment Banking

Capital markets innovation

Security token offerings

End-to-end platform for issuing, distributing, and trading digital securities.

Digital asset trading

Institutional trading desk infrastructure with best execution and compliance monitoring.

Prime brokerage

Custody, lending, and trading services for hedge funds and institutional clients.

Asset management

Portfolio management, fund administration, and performance reporting for digital assets.

Retail Banking

Next-generation consumer banking

Consumer crypto accounts

Integrated cryptocurrency trading and custody within existing banking apps.

Digital identity solutions

Self-sovereign identity with KYC portability across financial institutions.

Loyalty tokenization

Blockchain-based reward programs with transferable points and partner redemption.

Mortgage and lending

Tokenized mortgages, automated underwriting, and secondary market trading.

Wealth Management

Digital asset allocation

Portfolio construction and rebalancing across traditional and digital assets.

Tokenized alternative assets

Access to private equity, real estate, and other alternatives through tokenization.

Automated tax optimization

Tax-loss harvesting and reporting for complex digital asset portfolios.

Family office services

Multi-generational wealth transfer and estate planning using blockchain technology.

Compliance & Risk Management

Automated regulatory reporting

Generate reports for Basel III, Dodd-Frank, MiFID II, and other global regulations.

Real-time risk monitoring

AI-powered surveillance for market manipulation, fraud detection, and compliance breaches.

Audit trail management

Immutable record-keeping with complete transaction history and compliance documentation.

Sanctions screening

Real-time monitoring against global watchlists and sanctions databases.

Key Banking Features

API connectivity to core banking systems

- Real-time synchronization with general ledger

- Integration with payment processing networks

- Compliance with banking security standards

Security & Insurance

- SOC 2 Type II certification

- $500M custody insurance

- Regular penetration testing

- Bank-grade encryption and key management

Global Compliance

- Support for 100+ regulatory jurisdictions

- Automated travel rule compliance

- Tax reporting (1099, Capital Gains)

- Local licensing requirements management

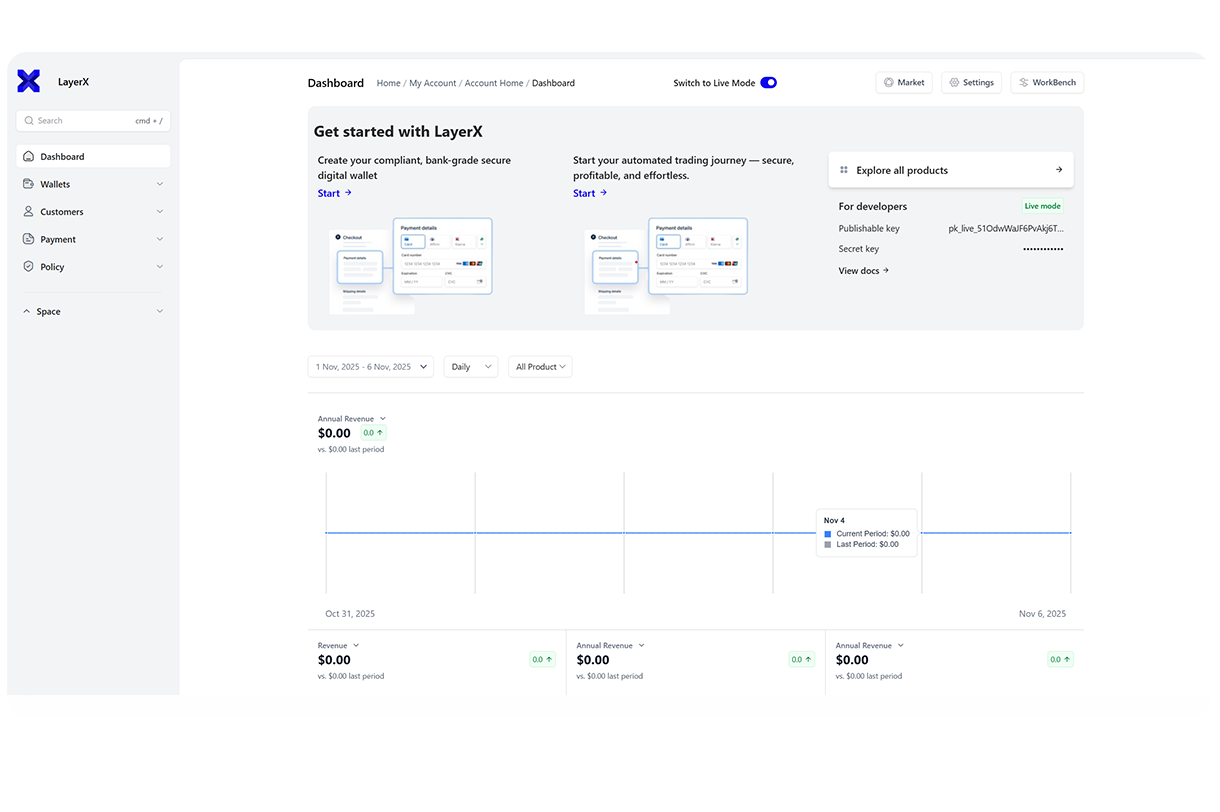

Reporting & Analytics

- Real-time balance sheet monitoring

- Liquidity coverage ratio calculations

- Risk-weighted asset reporting

- Customer activity monitoring

Implementation Framework

Phase 1: Foundation (4-6 weeks)

- Regulatory compliance setup

- Core system integration

- Security infrastructure deployment

- Staff training and certification

Phase 2: Product Launch (6-8 weeks)

- Digital asset custody services

- Basic trading and transfers

- Customer onboarding flows

- Compliance monitoring activation

Phase 3: Expansion (8-12 weeks)

- Advanced trading capabilities

- Tokenized asset issuance

- Cross-border payment rails

- Wealth management integration

Banking Leader Testimonials