Fintech Platforms

Next-generation financial infrastructure for modern fintech platforms

Power your fintech platform with unified financial infrastructure

01

Unified financial data & operations

Aggregate traditional banking, digital assets, and alternative financial data through a single API. Provide seamless user experiences across all financial touchpoints.

02

Real-time payment orchestration

Process instant settlements across fiat, crypto, and cross-border payments with intelligent routing and guaranteed delivery.

03

Regulatory compliance automation

Maintain global compliance with built-in KYC/AML, transaction monitoring, and reporting across 100+ jurisdictions.

Core Banking & Payments

Modernize your payment infrastructure.

Unified payments API

Process ACH, wire transfers, card payments, and crypto transactions through a single integration.

Real-time settlement engine

Enable instant fund movements between accounts, institutions, and blockchain networks with sub-second finality.

Cross-border optimization

Leverage crypto rails and traditional networks to reduce international transfer costs by up to 80% while improving speed.

Digital Asset Integration

Seamlessly embed crypto capabilities

Multi-chain wallet infrastructure

Provide secure, non-custodial and custodial wallet solutions supporting 300+ blockchains and thousands of assets.

Institutional-grade trading

Embed swap functionality, liquidity access, and advanced trading features with best-execution guarantees.

Yield & earning products

Launch savings accounts, staking services, and yield-generating products with automated risk management.

Data & Analytics

Transform financial data into insights

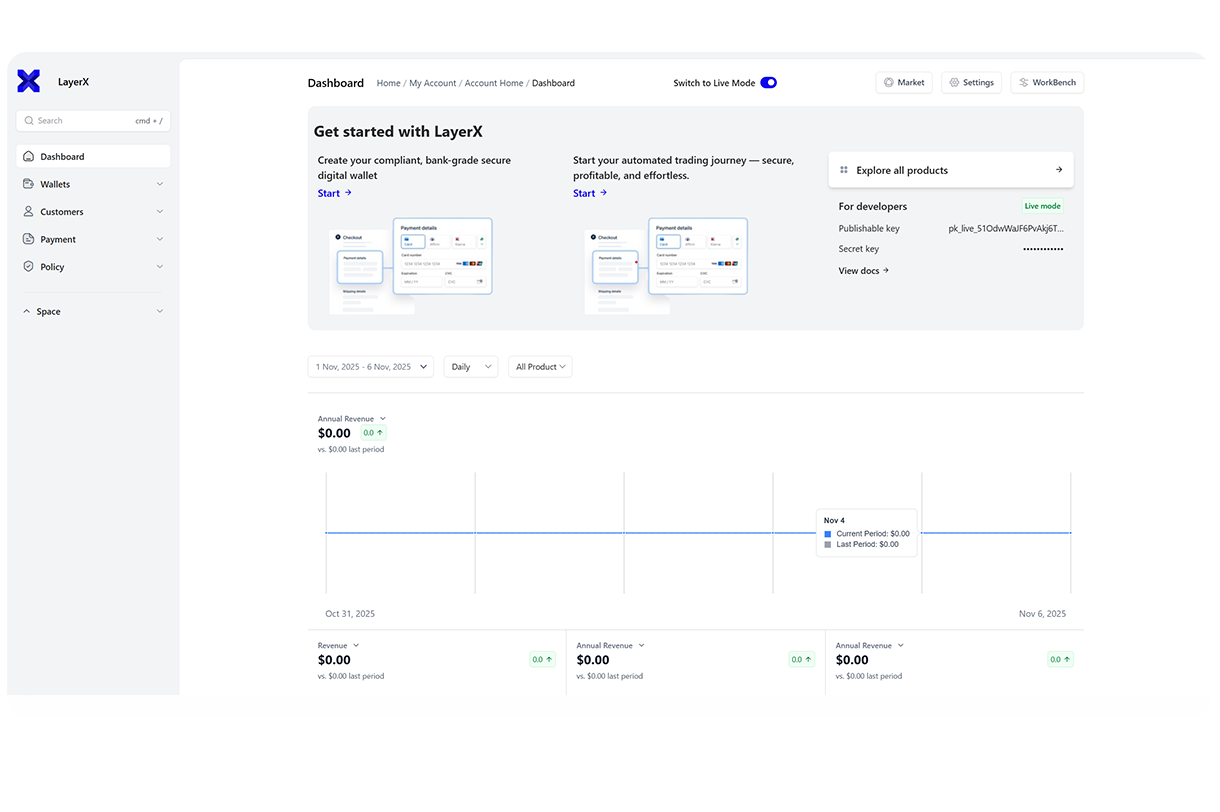

Unified financial dashboard

Give users complete visibility into their net worth across bank accounts, investment portfolios, and digital assets.

AI-powered financial insights

Provide personalized recommendations, spending analysis, and wealth management insights using machine learning.

Real-time risk monitoring

Monitor transaction patterns, market exposure, and compliance status with proactive alerting and reporting.

Compliance & Security

Enterprise-grade security for financial services with automated compliance, fraud detection, and institutional protocols.

Automated regulatory compliance

Built-in KYC, KYB, AML, and travel rule compliance with automated reporting for global operations.

Advanced fraud detection

AI-powered anomaly detection identifies suspicious patterns across fiat and crypto transactions in real-time.

Institutional security protocols

MPC technology, SOC 2 compliance, and insurance coverage for digital assets up to $500M.

Technical Excellence

Performance & Reliability

99.99% uptime SLA, <100ms API response times, 10,000+ transactions per second, Global edge network with 50+ locations

Security & Compliance

SOC 2 Type II certified, ISO 27001 compliant, GDPR and CCPA ready, Regular third-party security audits

Developer Experience

Comprehensive REST and GraphQL APIs, SDKs in 8 programming languages, Detailed documentation and tutorials, Dedicated technical support

Use Cases

Neo-banks & Digital Banks

Multi-currency accounts with crypto integration, Real-time global payments, AI-powered financial management, Embedded investment products

Investment Platforms

Unified traditional and digital asset trading, Portfolio management across all asset classes, Automated tax optimization and reporting, Institutional-grade security and compliance

Payment Processors

Cross-border payment optimization, Crypto payment acceptance and settlement, Fraud prevention and risk management, Multi-currency treasury management

Wealth Management

Digital asset portfolio management, Automated rebalancing and tax harvesting, Family office and institutional reporting, Compliance and audit trail generation

Enterprise-Grade Features

Dedicated Infrastructure

Isolated processing environments, Custom deployment options, Dedicated node clusters, Private blockchain connectivity

Custom Workflows

Tailored compliance rules, Custom settlement logic, Branded user experiences, Proprietary integration patterns

Premium Support

24/7 dedicated engineering support, Account management and strategic guidance, Custom feature development, Training and certification programs

Key Integration Features

What Fintech Leaders Say