Unify global financial operations across 300+ chains

01

Institutional-grade oversight

Maintain complete visibility and control over multi-chain treasury operations, cross-border payments, and digital asset movements across your entire organization.

02

Real-time enterprise intelligence

Monitor all transactions, liquidity positions, and compliance status with AI-powered dashboards and real-time alerts designed for complex global operations.

03

Predictive analytics for strategic advantage

Leverage machine learning to forecast market movements, optimize capital allocation, and automate risk management across your digital asset portfolio.

Global Payments & Settlements

Enterprise-scale payment infrastructure

Process billions in cross-border transactions with institutional-grade security, compliance, and settlement finality across 300+ blockchains.

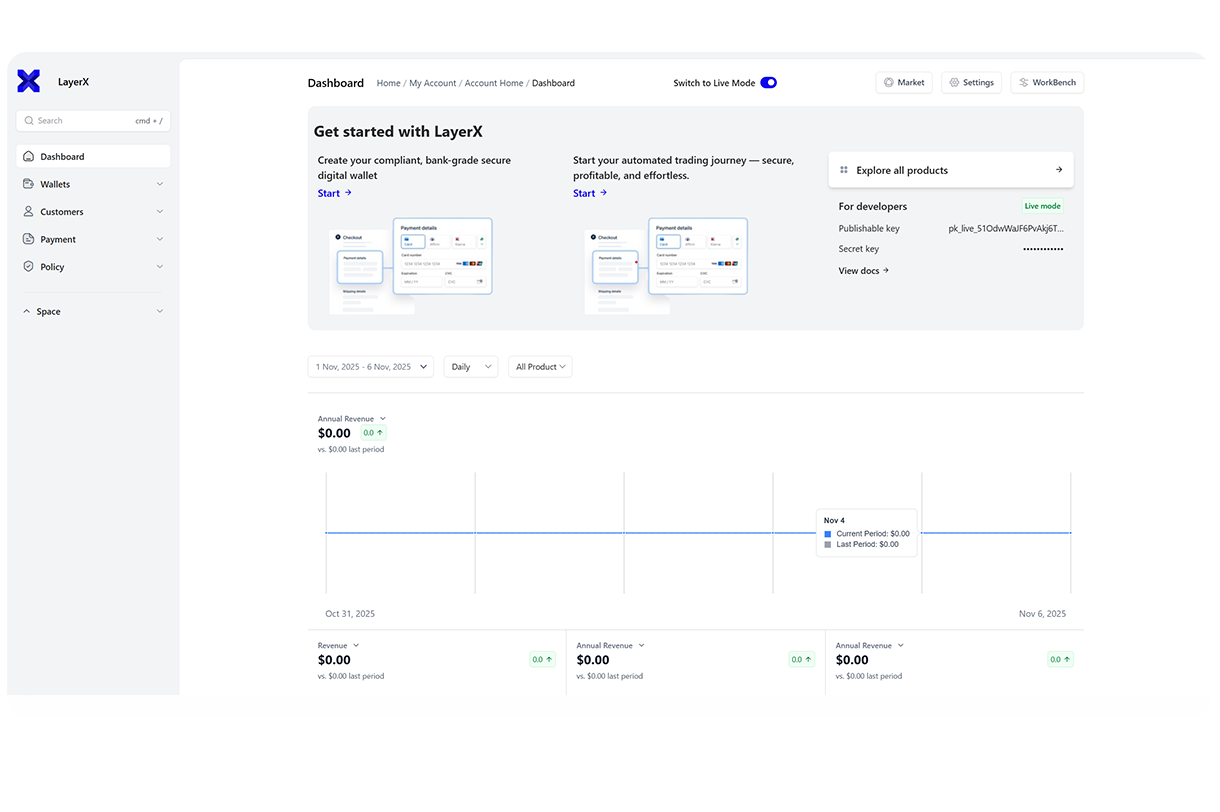

Centralized payment orchestration

Manage all fiat and digital asset payments through a unified dashboard with multi-signature approvals, custom workflows, and automated reconciliation.

Cross-chain settlement engine

Execute atomic settlements across multiple blockchains and traditional banking systems with guaranteed delivery and sub-second latency.

Regulatory compliance automation

Built-in KYC/AML, travel rule compliance, and automated reporting across 100+ jurisdictions ensure global operations remain compliant.

Institutional Treasury Management

Sophisticated treasury operations at scale

Manage complex capital structures, multi-currency positions, and yield strategies with enterprise-grade security and controls.

Multi-entity financial consolidation

Aggregate balances, track exposures, and manage liquidity across subsidiaries, departments, and global entities in real-time.

AI-driven liquidity optimization

Automatically allocate capital across chains, protocols, and traditional instruments to maximize yield while maintaining risk parameters.

Enterprise-grade security protocols

MPC technology, hardware security module integration, and SOC 2 Type II compliance protect your organization's digital assets.

Security & Compliance Framework

Built for regulated institutions

Meet the highest standards of security, auditability, and regulatory compliance required by global financial institutions.

Advanced threat detection & response

24/7 AI-powered monitoring detects and neutralizes sophisticated threats across all connected chains and systems.

Comprehensive audit trail

Maintain immutable records of all transactions, policy changes, and access attempts with enterprise-grade logging and reporting.

Custom compliance workflows

Implement bespoke approval hierarchies, transaction limits, and regulatory controls tailored to your organization's requirements.

Integration & Customization

Seamlessly integrate with enterprise systems

Connect LayerX to your existing financial infrastructure with enterprise-grade APIs and dedicated support.

ERP & accounting system integration

Real-time synchronization with SAP, Oracle, NetSuite, and other enterprise resource planning systems.

Custom development & white-label solutions

Dedicated engineering support for custom integrations, proprietary protocols, and white-labeled solutions.

24/7 enterprise support

Priority technical support, dedicated account management, and SLAs tailored to enterprise requirements.

Enterprise Deployment Options

Choose the deployment that fits your security needs

What Enterprise Leaders Are Saying