Autonomous trading that executes 24/7

TX Auto Trade automates the most complex aspects of digital asset trading—from strategy execution to risk management—operating with precision across all market conditions.

AI-Enhanced Strategy Optimization

Our system continuously analyzes market data, execution patterns, and strategy performance to dynamically optimize parameters. The AI adjusts position sizing, entry/exit timing, and risk exposure in real-time to maximize risk-adjusted returns.

Multi-Venue Execution Intelligence

Automatically route orders across centralized exchanges, DEXs, and liquidity pools for optimal execution. The system analyzes venue reliability, liquidity depth, and fee structures to minimize slippage and maximize fill rates.

Cross-Chain Arbitrage Automation

Seamlessly execute arbitrage strategies across 300+ blockchains. Our AI identifies price discrepancies, funding rate differentials, and cross-venue opportunities, executing complex multi-chain trades autonomously.

Institutional-grade algorithmic trading made simple

A powerful yet intuitive platform for creating, testing, and deploying sophisticated trading strategies without building complex infrastructure.

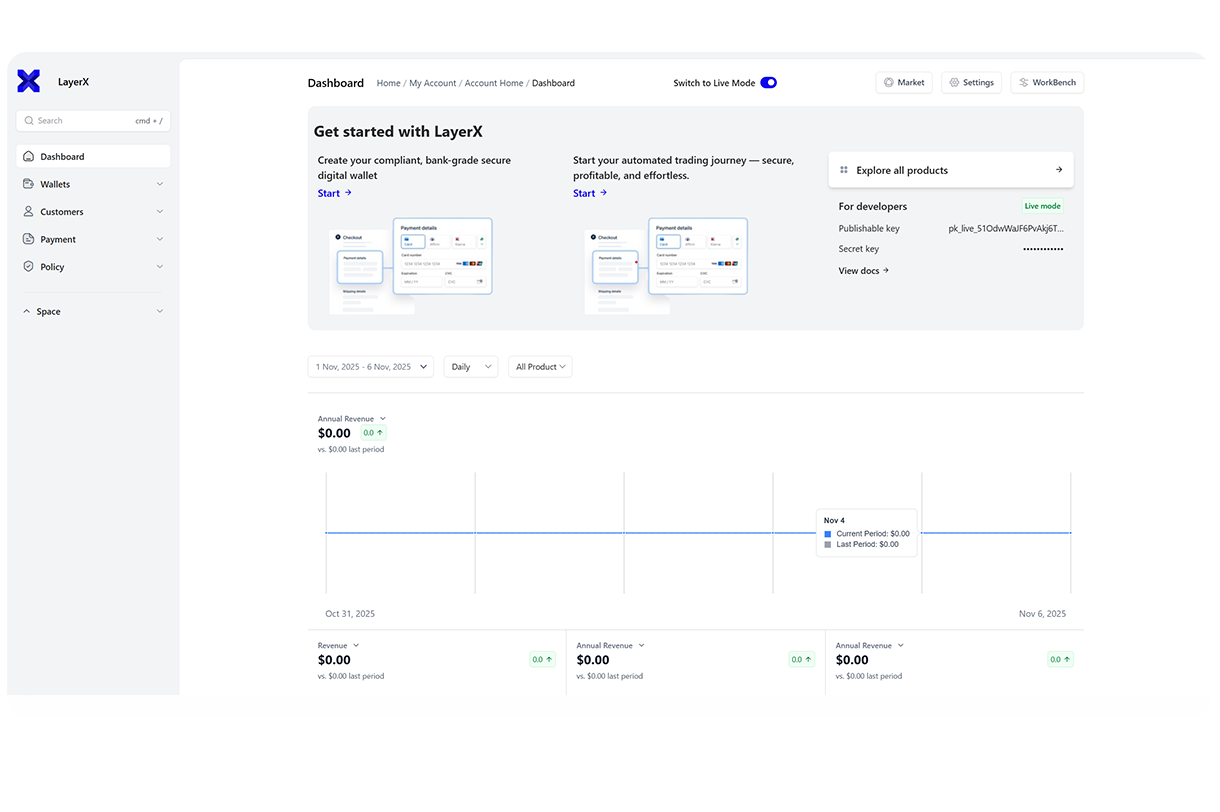

Unified Trading Dashboard

Monitor all active strategies, performance metrics, and risk exposure from a single interface. Track P&L, Sharpe ratios, drawdowns, and execution quality across your entire portfolio

Visual Strategy Builder

Create and modify complex trading algorithms without coding. Use our drag-and-drop interface to define technical indicators, risk parameters, and execution logic through an intuitive visual workflow

Pre-Built Strategy Templates

Accelerate deployment with professionally-designed templates:

- Market Making with dynamic spread adjustment

- Mean Reversion with volatility-based positioning

- Trend Following with multi-timeframe confirmation

- Arbitrage Strategies across venues and chains

Comprehensive Exchange Integration

Connect TX Auto Trade to your entire trading ecosystem:

- 50+ Centralized Exchanges with unified API

- Major DEXs and AMMs across all chains

- Data Providers for real-time market feeds

- Risk Management systems for exposure monitoring

Intelligent trading analytics that drive alpha generation

Move beyond basic performance metrics to predictive insights that optimize strategy performance and risk management.

Real-Time Strategy Analytics

Monitor strategy performance, execution quality, and risk metrics across all deployments. Track alpha generation, beta exposure, and capacity utilization with institutional-grade precision.

Predictive Market Regime Detection

Our AI models analyze market structure, volatility patterns, and macroeconomic indicators to forecast regime changes. Automatically adjust strategy parameters or allocation based on predicted market conditions.

Smart Risk Intelligence

Automatically monitor and manage strategy risks including drawdown limits, concentration risks, and counterparty exposure. The system provides real-time alerts and can automatically reduce position sizes or pause strategies when risk thresholds are breached.

Performance Attribution Analytics

Decompose returns by strategy component, market factor, and execution quality. Identify what's driving performance and optimize strategy allocation based on empirical evidence rather than intuition.

TX Auto Trade delivers institutional-grade performance

- 300+ integrated chains and trading venues

- <10ms average execution latency

- 99.95% strategy uptime SLA

- 45% average reduction in slippage vs. manual trading

Features

AI Strategy Optimization

Multi-Venue Order Routing

Cross-Chain Arbitrage Engine

Advanced Backtesting Suite

Real-Time Risk Management

Portfolio Strategy Management

Market Making Automation

Mean Reversion Strategies

Trend Following Systems

Liquidity Provisioning

Smart Order Types

Comprehensive Reporting

Transform your trading operations with institutional-grade algorithmic execution