Autonomous treasury operations that work 24/7

TX Treasury automates the most complex aspects of digital treasury management—from cash positioning to cross-chain settlements—executing with precision and intelligence around the clock.

AI-Optimized Liquidity Management

Our system continuously monitors balances across all connected accounts and chains, automatically executing sweeps, rebalancing, and yield optimization to ensure optimal capital allocation without manual intervention.

Automated Cross-Chain Settlements

Seamlessly move assets between blockchains and traditional banking systems. The AI dynamically selects the most efficient settlement paths, bridging assets and executing transfers while minimizing costs and settlement times.

Smart Payment & Distribution Workflows

Automate complex payment schedules, payroll, vendor payments, and treasury operations with intelligent approval workflows. Set rules for automatic execution while maintaining appropriate controls and audit trails.

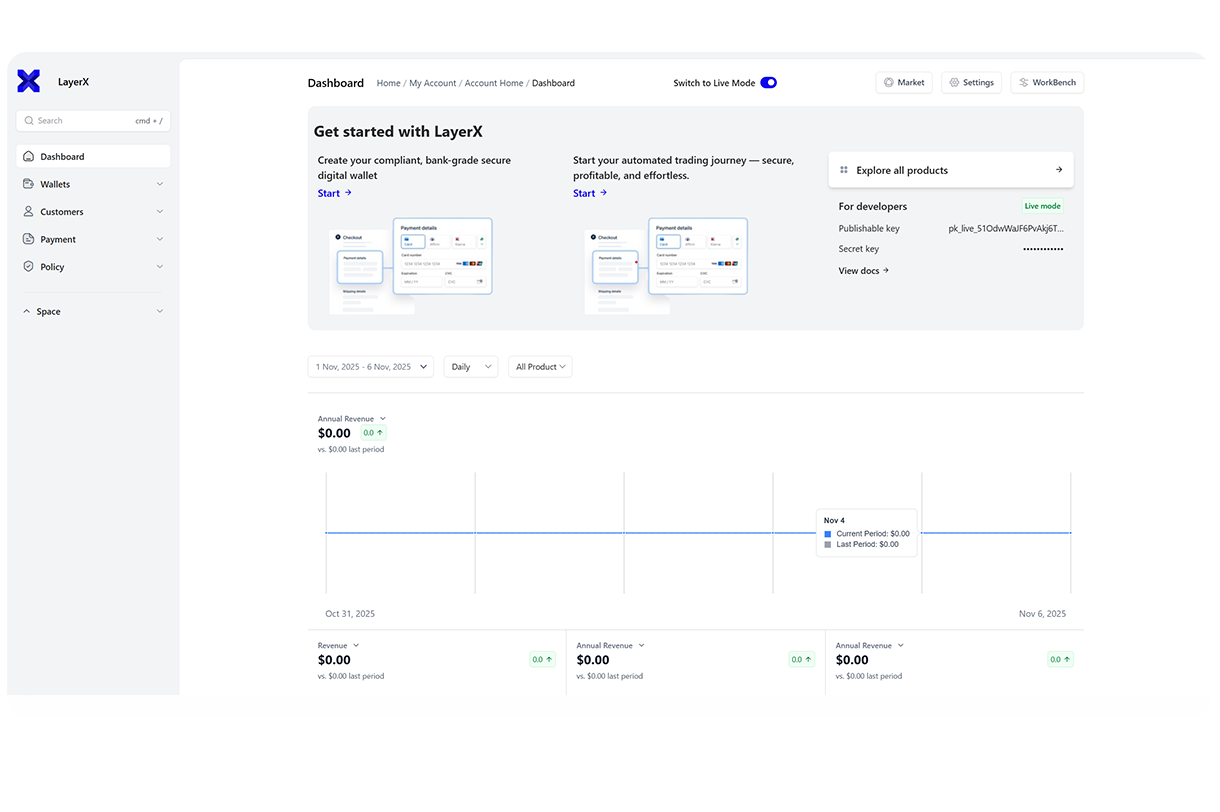

Enterprise-grade treasury management made simple

A unified interface for managing all financial operations across traditional banking and digital assets, with enterprise-grade security and controls.

Unified Financial Dashboard

Monitor all assets—crypto, fiat, tokens, and traditional investments—from a single interface. Track balances, cash flow, exposure, and performance across all accounts and chains in real-time

Visual Workflow Builder

Create and modify financial automation rules without technical expertise. Use our drag-and-drop interface to define cash management rules, payment approvals, and risk parameters

Pre-Built Treasury Templates

Accelerate deployment with industry-specific templates:

- Daily Cash Positioning & liquidity management

- Multi-Chain Portfolio Rebalancing

- Automated Payment Processing

- Risk-Managed Treasury Operations

Comprehensive Financial Integration

Connect TX Treasury to your entire financial ecosystem:

- Traditional Banking via API connections

- Payment Processors and gateway APIs

- Accounting Systems (QuickBooks, NetSuite, Xero)

- Blockchain Networks across all supported chains

Intelligent treasury analytics that drive better decisions

Move beyond basic balance tracking to predictive insights that optimize capital allocation and financial strategy.

Real-Time Cash Position Monitoring

Track your organization's complete financial position across all accounts and chains. Monitor liquidity ratios, exposure concentrations, and cash flow patterns with institutional-grade precision.

Predictive Cash Flow Forecasting

Our AI models analyze historical patterns, market data, and business metrics to forecast future cash positions. Anticipate liquidity needs, optimize working capital, and make informed investment decisions.

Smart Risk Exposure Analytics

Automatically identify and quantify financial risks across currencies, chains, and counterparties. Monitor concentration risks, volatility exposure, and regulatory compliance status in real-time.

Performance Optimization Insights

Receive AI-driven recommendations for improving capital efficiency, reducing costs, and enhancing yield. Optimize asset allocation, minimize transaction costs, and identify revenue opportunities across your entire portfolio.

TX Treasury delivers enterprise-grade financial management

- 300+ blockchains and traditional banking unified

- 99.95% system availability SLA

- <30s real-time balance synchronization

- 75% reduction in manual treasury operations

Features

Unified Balance Aggregation

AI Cash Forecasting

Automated Sweep Accounts

Cross-Chain Settlement Engine

Multi-Currency Management

Payment Automation

Risk Monitoring & Alerting

Regulatory Reporting

Yield Optimization

Approval Workflow Management

Real-time Reconciliation

API-First Architecture

Transform your treasury operations with intelligent, automated financial management